Understanding Tax Planning and Advice for Your Business

In today's intricate financial landscape, tax planning and advice has emerged as a crucial element for businesses aiming to maximize their profitability and ensure compliance with regulatory frameworks. This comprehensive guide delves into various aspects of tax planning, detailing strategies that can benefit both small businesses and large corporations alike.

What is Tax Planning?

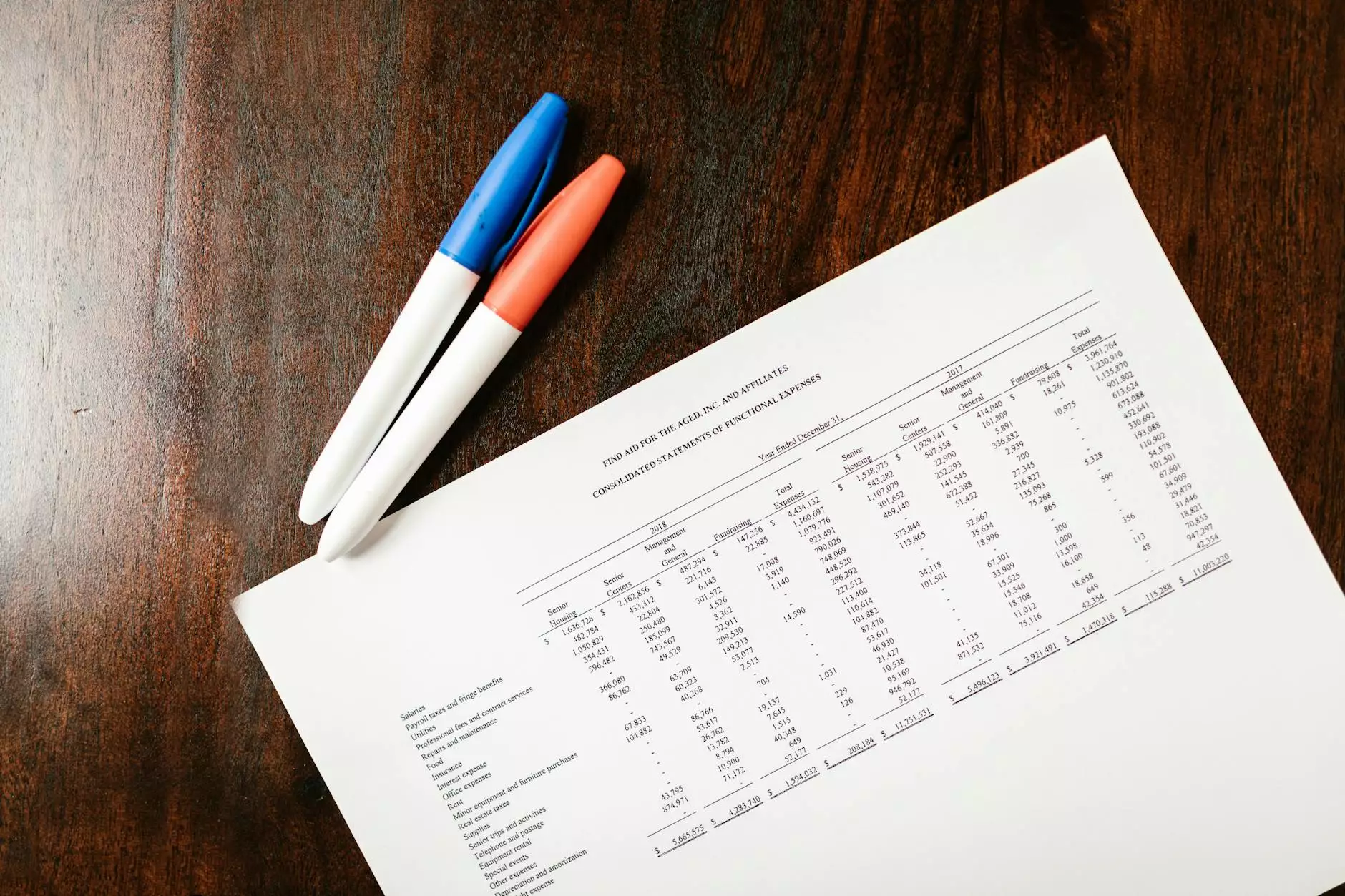

Tax planning involves analyzing financial situations from a tax perspective to ensure tax efficiency. The primary goal of tax planning is to minimize tax liabilities while complying with the law. This proactive strategy allows businesses to keep more of their earnings for reinvestment or distribution, ultimately enhancing their bottom line.

Key Components of Effective Tax Planning

- Understanding Tax Obligations: It's essential to be aware of the various taxes a business may be liable for, including income tax, payroll tax, sales tax, and property tax.

- Creating a Tax-efficient Structure: Choosing the right business structure (LLC, corporation, etc.) can significantly impact tax obligations and benefits.

- Utilizing Tax Deductions and Credits: Taking full advantage of allowable deductions and credits can considerably reduce taxable income.

- Implementation of Retirement Plans: Establishing retirement accounts can provide tax benefits that are advantageous for both employers and employees.

- Annual Review and Adjustment: Regularly reviewing financial situations and tax strategies ensures that businesses remain compliant and can adjust to any changes in financial conditions or tax laws.

The Importance of Professional Tax Advice

While many business owners attempt to handle their tax planning in-house, the complexity of tax laws often necessitates professional tax advice. Here are several reasons why seeking expert counsel is beneficial:

1. Expertise in Tax Laws

Tax laws are continually evolving. A knowledgeable tax professional stays updated on the latest regulations and can provide insight into how changes may affect your business. This expertise can protect against costly mistakes and ensure compliance.

2. Customized Solutions

Every business has unique needs. A professional can tailor tax strategies specifically for your company, addressing its specific circumstances, industry requirements, and financial goals.

3. Long-term Planning

Effective tax planning is not just about immediate tax savings; it's also about long-term financial strategy. Advisors can help you forecast future tax obligations and structure your business operations to minimize future liabilities.

4. Audit Preparedness

In the event of an audit, having a well-documented tax strategy in place can be invaluable. Professional advice ensures that all necessary records are maintained, and that your business is prepared to defend its tax positions.

Strategies for Tax Planning in Your Business

Effective tax planning and advice incorporate a variety of strategies that businesses can leverage to optimize their tax situations. Here are several proven strategies:

1. Accelerate Deductions

Deducting expenses can significantly reduce taxable income. To accelerate deductions, businesses may consider prepaying certain expenses before the end of the tax year. Common expenses include:

- Rent

- Utilities

- Insurance premiums

2. Defer Income

Where feasible, deferring income to the next tax year can lower your current year's taxable income. This strategy is especially effective for businesses that anticipate being in a lower tax bracket in the subsequent year.

3. Use Retirement Plans

Implementing retirement savings plans like a 401(k) can provide tax deductions for contributions made on behalf of employees. Moreover, contributions made to these plans are typically tax-deferred until withdrawal, resulting in tax savings.

4. Understand State-Specific Tax Credits

Various states offer specific tax credits that may apply to your business operations. Engaging with a tax professional knowledgeable about your state’s incentives can help you benefit from these opportunities.

5. Consider a Section 179 Deduction

The Section 179 deduction allows businesses to deduct the full price of qualifying equipment and software purchased or financed during the tax year. This can greatly reduce your overall tax bill, especially for capital-intensive businesses.

Tax Planning for Larger Corporations

Larger corporations face unique challenges and opportunities regarding tax planning. Here, sophisticated strategies are often required:

1. International Tax Strategies

For multinationals, understanding international tax laws and treaties can lead to significant savings through effective tax structuring and repatriation strategies.

2. Mergers and Acquisitions

Tax implications of mergers and acquisitions must be carefully assessed. Professional advice is critical to navigating the tax landscape during these complex transactions.

3. Transfer Pricing

Businesses with subsidiaries in various jurisdictions must adhere to transfer pricing laws, which dictate that transactions between related business entities must be conducted at arm's length. Proper documentation and strategy are key to compliance.

Keeping Up with Tax Laws and Changes

The landscape of taxation can change dramatically, often based on new legislation, evolving regulations, or shifts in economic policy. Keeping abreast of these changes is essential for sound tax planning and advice. Here's how:

- Regularly Review Tax Policies: Make it a practice to review tax legislation at least annually to identify any impacts on your business.

- Engage with Tax Professionals: Maintain a relationship with tax professionals who can alert you to relevant changes and help adapt strategies accordingly.

- Utilize Online Resources: Platforms such as IRS updates, state tax department announcements, and reputable financial news sources can provide valuable information.

Conclusion: The Power of Strategic Tax Planning

In conclusion, effective tax planning and advice serve as the backbone of a successful financial strategy for any business. By implementing these strategies and seeking professional guidance, businesses can enjoy enhanced profitability, reduced liabilities, and increased compliance with tax regulations. Engaging with experts in tax law, particularly within vital business categories such as criminal defense law and personal injury law, is essential for navigating the multifaceted obligations that arise in a business context.

Act Now: Seek Professional Tax Assistance

If you are looking to optimize your tax strategy and ensure compliance, consider contacting AJA Law Firm today. Our team of dedicated professionals is ready to assist you with all your tax planning needs, providing tailored solutions that fit your business’s unique landscape.